Bookkeeper Business Launch Review by Ben Robinson

Bookkeeper business launch (or Bookkeeper launch) is the best virtual bookkeeping training available today.

2022 Update: Bookkeeper business launch will now be Bookkeeper Launch.

It is started by Ben Robinson, a former CPA who has trained over 3000 students on how to start a bookkeeping business from home.

But, before investing in any work from home courses, we need to know whether or not it is legit.

So, here is a detailed review of Bookkeeper Business Launch which includes answer to: is bookkeeper business launch worth it. Let’s begin

The post includes affiliate links.

Want to make money quickly? Here are a few platforms to earn up to $25 – $50 in a few minutes!

- Freecash: Get your own free account, complete small tasks, start collecting coins and cash them out. They’re giving out $500 a day & over $2500+ to their top users. Sign up here.

- PineCone Research: Earn $3 – $5 per each survey guaranteed.Sign up now

- SurveyJunkie: With each survey, you can earn up to $3 – $7 easily. Signup here

- HarrisPoll: Get paid to watch videos, play games, and shop online. Also, get a Signup bonus. You can get signup now

- Rakuten: Up to $50 per survey & $0.50 per email. $5 per referring friend, sharing payment receipts. Join now for FREE.

- Neilsen Computer and Mobile panel: Get paid to ONLY install the app and do nothing else.

Looking for other paid survey opportunities? Check out how to make $100 per survey and the highest-paying survey companies.

- Bookkeeper Business Launch Review by Ben Robinson

- Bookkeeper Business Launch (Bookkeeper Launch) – Is it a scam or not?

- Bookkeeper Business Launch or Bookkeeper Launch review: Part I, Part II and Part III

- Part I – Bookkeeper Business Launch course overview

- What is Bookkeeper Business Launch?

- Who’s Behind Bookkeeper Business Launch?

- What do you get inside the Bookkeeper Business Launch Course?

- How Much is Bookkeeper Business Launch?

- How Much Money Can Be Made with Bookkeeper Business Launch?

- Bookkeeper Business Launch Review: Is bookkeeper business launch worth it?

- Part II – Bookkeeper business launch review – Meet Kevin Schmidt

- #1 Tell me something about yourself. What were you doing before you started bookkeeping?

- #2 Why and how did you decide to pursue this career? What was the driving factor?

- #3 What does bookkeeping involve?

- #4 When did you take Bookkeeper Business Launch?

- #5 Were you hesitant in the beginning?

- #6 Why did you choose to go with Ben's course? Did you any bookkeeper business launch review helped?

- #7 How much bookkeeper business launch cost?

- #8 How long did you take to complete the bookkeeper business launch course?

- #9 How is Ben as a mentor? [is he available to help you with your career]

- #10 Can the course be completed and actions can be taken while raising kids? How much time did you spend each day on building a bookkeeping business?

- #11 Does the course cover everything you need to know about bookkeeping?

- #12 How long after completing the course did you land your first client?

- #13 How long did you take to recover the cost you invested in the course?

- #14 How much do you make a month doing this? Do you do this full time or part-time?

- #15 Please share any negatives and positive of the course (any drawback you would like to share)

- #16 Do you think the course was necessary or you could have found the information for free on the internet?

- #17 How does it with clients (a little brief about where to get them, what kind of clients, how long are they signed up for etc)

- #18 How many hours do you work in a day?

- #19 What according to you are the most important traits to be a successful bookkeeper?

- #20 Do you think is a great job for a stay at home parent? Is it more suitable for parents of children who go to school or it is great for toddler parents as well.

- #21 Do you have any advice for someone considering this career choice?

- #22 How many kids do you have?

- #23 How do you manage time and still raise a family?

- #24 Is there anything else you want to share [Please tell us about anything you feel a beginner or someone interested in this WFH option should know]

- Part III – Quick FAQ's about Bookkeeping from home

- Do I need a college degree or experience to start bookkeeping from home?

- Why Bookkeeping is a great work from home option?

- Is virtual bookkeeping legit?

- How much do virtual bookkeepers from home earn?

- What are your daily tasks as a bookkeeper from home?

- Why not go a university or a community college to take bookkeeping classes or training?

- Is online bookkeeping legit?

- $2697 is an AWFUL lot of money to spend on a program. Is there a guarantee?

- Bookkeeper Business Launch Review – Learn to be a online bookkeeper

Bookkeeper Business Launch (Bookkeeper Launch) – Is it a scam or not?

No, bookkeeper launch (previously known as bookkeeper business launch) is legit.

Bookkeeper Business Launch is NOT a scam and with little internet research, you can find a lot about it.

In short, it is a 100% legitimate work at home course and if you are on the fence, I would say go for it.

If you are ready to become a bookkeeper, start learning the tricks of the trade, be sure to check out this free online course on bookkeeping.

Not only does it tell you what is required to be a bookkeeper, but it also discusses whether or not you are right for this work at home job!

Bookkeeper Business Launch or Bookkeeper Launch review: Part I, Part II and Part III

- Part I – A detailed overview of the Bookkeeper Launch course (the modules, add ons etc)

- Part II – An interview with Kevin who is a stay at home dad for 3 kids and earns $8000+ as a bookkeeper from home.

He took Bookkeeper Business Launch, shares his honest review and talks about starting a bookkeeping business with kids - Part III – FAQs on virtual bookkeeping from home

Part I – Bookkeeper Business Launch course overview

What is Bookkeeper Business Launch?

Bookkeeper Business Launch (or Bookkeeper launch) or BBL is a step by step system that show how to set up your home based bookkeeping business in 10-12 weeks or less.

Not only does it teach you the essential skills to become a professional bookkeeper, but it also shows you how to set up business, attract clients and charge premium rates

The course covers

- Bookkeeping skills (of course, you need to learn your tasks!)

- Marketing your business – how to wow your clients, charger premium rates, attracting quality bookkeeping clients etc

- How to set up your business and get bookkeeping jobs (by the way, you get access to an attorney paid for by Ben Robinson so you can shoot questions and ensure that your bookkeeping business abides by the law)

- Advanced marketing strategies for when you are already above the ground

- Live, week Q&A calls with instructors. You get one on one guidance which is one of the best features of bookkeeper business launch

- Support group with over 4000 bookkeeping students

The course starts with basics, so you do not need to worry if you have no bookkeeping education or experience in the past.

Who’s Behind Bookkeeper Business Launch?

Are you are wondering why we need to include a brief about Ben Robinson in Bookkeeping Business Launch Review?

Because he is the creator of the course and his qualifications, background and experience provide credibility to it.

Ben Robinson created Bookkeeper Business Launch (Bookkeeper Launch now)

He is a former certified public accountant (CPA) and he ran his own CPA firm once.

In his career and experience, he realised the importance of good bookkeepers in the industry.

According to him, he has helped over 3000 students launch a profitable bookkeeping business since the inception bookkeeper business launch in 2015.

What do you get inside the Bookkeeper Business Launch Course?

We will look at both – free course as well as the paid bookkeeper business launch course.

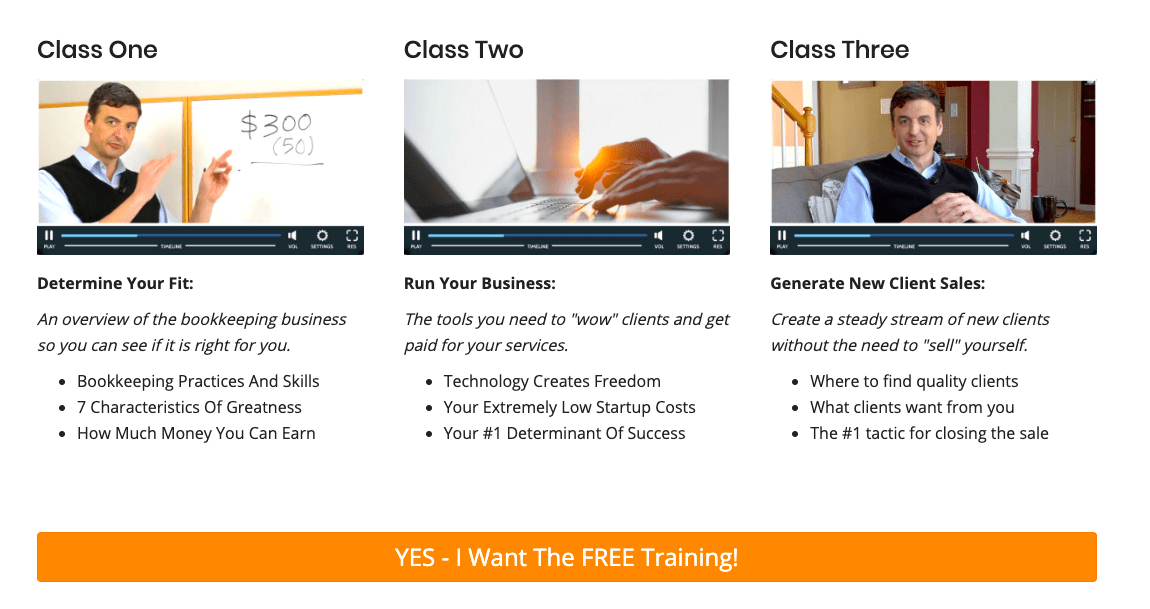

Free Bookkeeping Beginner Course

If you want to know more about Ben Robinson’s style of teaching and bookkeeping business, I recommend you sign up in the free classes.

It is divided into four free classes.

Sign up for this free course to understand how to become a bookkeeper from home

Free Bookkeeping Training Class 1 – The Basics

As any class should, the first class deals with the business of bookkeeping from home and the earning potentials.

According to Ben, the general tasks of a bookkeeper is to focus on GRAB

- G – Gathering Facts

- R – Report

- A – Analyse

- B – Be available for your client

Besides that, he also covers the personality traits of a successful bookkeeper. According to him if you can

- Pay attention to details

- Be organized

- Be personable

- Multi-task

- Work hard and

- Keep a positive outlook no matter what

you are meant to become a bookkeeper

Free Bookkeeping Training Class 2 – Tech and Tools

The second class focuses on technology and tools for bookkeepers along with the basic requirements of starting a business.

It also estimates the start up costs and recurring costs of running bookkeeping business from home.

Free Bookkeeping Training Class 3 – Pitching and finding clients

This is a fun and meaty class. Ben talks about how to start pitching and securing clients for your bookkeeping business.

Free Bookkeeping Training Class 4 – Walkthrough

This class provides you important information on the Bookkeeping Business Launch course. It also helps you to sign up for the full course.

Sign up for this free course to understand how to become a bookkeeper from home

What is covered in the the Paid Course of Bookkeeper Launch

There are three units in the Bookkeeper Business Launch (or bookkeeper launch) to learn essential skills along with several power ups to learn about starting a bookkeeping business.

To give you an overview,

- CATEGORY #1 – 21ST CENTURY BOOKKEEPING SKILLS is all

about becoming a high quality bookkeeper. - CATEGORY #2 – 21ST CENTURY CLIENTS is where you’ll get your first handful of clients to get your business off the ground.

- CATEGORY #3 – 21ST CENTURY BUSINESS SYSTEMS is where you’ll develop the systems you’ll need to succeed (and run your business day-to-day.)

- POWER UNITS are perfect for when you’re ready to grow and scale your business.

Category #1 – 21st Century Bookkeeping Skills

| Foundations ● Bookkeeping Basics ● Financial Statements ● Journals & Ledgers ● Ethics & Laws | Setup ● Setup & Software ● Example Client Setup | Transactions ● Cash Receipts and Accounts Receivable ● Cash Disbursements and Accounts Payable ● Inventory ● Fixed Assets ● Notes Payable ● Other Liabilities ● Other Assets ● Equity ● Bank Feeds and Reconciliations |

| Transactions Projects ● Closing Project ● FInal Project | Statements ● Proof ● Prettify ● Package ● Present ●Troubleshooting | Cleanup ● Cleanup Process ● Cleanup Implementation |

| Final Exams ● Knowledge Exam – The Basics ● Knowledge Exam – Transactions & Statements ● Practical Exam |

Category #2 – 21st Century Clients

| Leader U ● Crash Course ● Take Leadership Action | Money U ● Get Ready to Earn ● Take Money Action | Yakkity-Yak ● How to Yakkity-Yak ● You Can Do It! |

| Traditional Networking ● How to Network ● Mix & Mingle | Irresistible Selling Statement ● ISS Introduction ● Creating Your ISS | Conversation to Close ● #1stClient ● Go Get ‘Em! |

| Online Networking ● How to Network Online ● Connect & Converse | Website & Social Media Marketing ● Your Website Challenge ● Your Social Media |

Category #3 – 21st Century Business Systems

| Lifestyle ● Breakthrough Framework ● Get Stuff Done | Your Money ● Money Truths ● Getting Strategic | Setup 7 ● Get Started ● Make It Official |

| Templates ● Essential Templates | Processes & Checklists ● Key Processes and Checklists | Tools & Tech ● Helpful Tools & Tech |

Power Units

| Interpret & Advise ● Review & Analyze ● Internal Controls ● Income Taxes | Spreadsheets ● Spreadsheets 101 ● Amortization & Depreciation Schedules | Prospect Follow-up System ● Gather Intel ● Prioritize & Follow-up |

| Email Outreach ● Using Email Outreach ● Implementation | Referral Partners ● Why Referral Partners Matter ● Effective Referral Partner Marketing | Niche Power ● Riches in the Niches ● Niche Research |

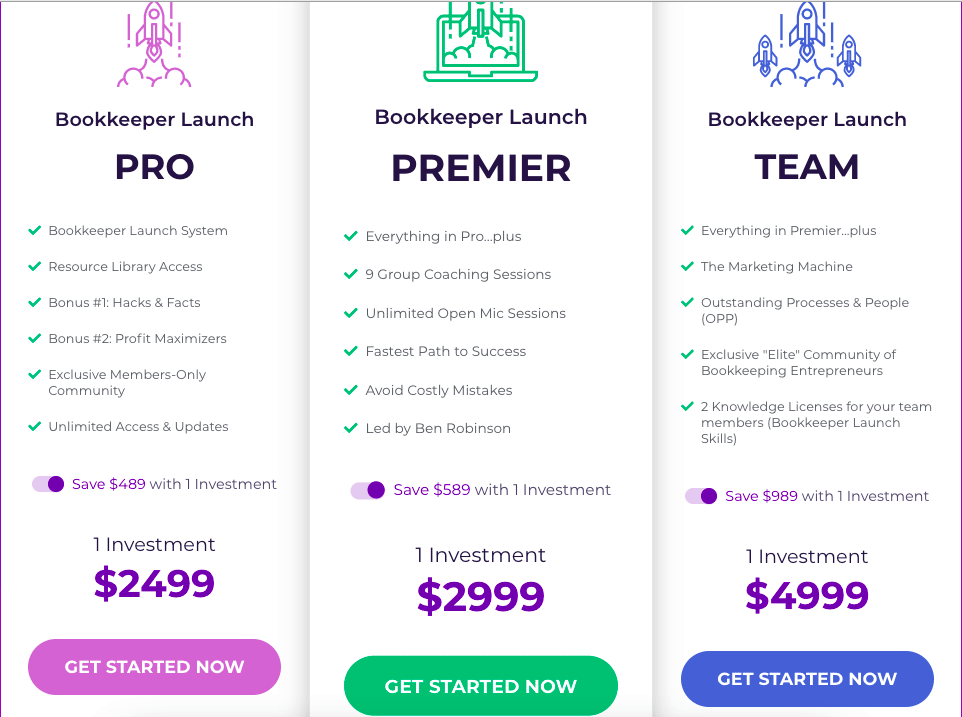

How Much is Bookkeeper Business Launch?

This is one of the most important questions – how much does the bookkeeper business launch cost?

There are three options in Bookkeeper Business launch.

- Bookkeeper Launch Pro – $2499

- Bookkeeper Launch System

- Resource Library Access

- Bonus #1: Hacks & Facts

- Bonus #2: Profit Maximizers

- Exclusive Members-Only Community

- Unlimited Access & Updates

- Bookkeeper Launch Premiere – $2999

- Everything in Pro…plus

- 9 Group Coaching Sessions

- Unlimited Open Mic Sessions

- Fastest Path to Success

- Avoid Costly Mistakes

- Led by Ben Robinson

- Bookkeeper Launch Team – $4999

- Everything in Premier…plus

- The Marketing Machine

- Outstanding Processes & People (OPP)

- Exclusive “Elite” Community of Bookkeeping Entrepreneurs

- 2 Knowledge Licenses for your team members (Bookkeeper Launch Skills)

If you are looking for instalment options, you will have to pay –

- Bookkeeper Launch Pro – 12 investments at $249 each

- Bookkeeper Launch Premiere – 12 investments at $299 each

- Bookkeeper Launch Team – 12 investment at $499 each

Wondering whats the difference between the three, this screenshot should clear it up for you:

In this Bookkeeper Business launch review, we will also tell you what you get after enrolling into the course

- Access to the entire program as we discussed above along with a resource library which include guides, templates, technology recommendations and worksheets you need to start your successful bookkeeping business

- Exclusive 7 day plan to launch your business

- You’ll get immediate and direct access to the Student Success Team (SST).

- 2 Weekly Live Q&As

- Unlimited Email Support

- Legal Lunch – Access to a professional lawyer where you can get advice on how to start a business

- Unlimited Bookkeeper Business Launch upgrades

- Unconditional Guarantee. If you’re not satisfied, simply click the Cancel button within 30 days of purchase and get refunded.

- If you don’t earn $4,000 in 90 days, they are willing to buy your bookkeeping business for $4,000 if you fulfil certain conditions

- if you don’t earn $4,000 within your first year, we will buy your bookkeeping business for $5,000 and donate $1,000 to your favorite charity

You can find all bookkeeping launch course details here

You should sign up for his free course to understand how to become a bookkeeper from home. It also answers all of your questions

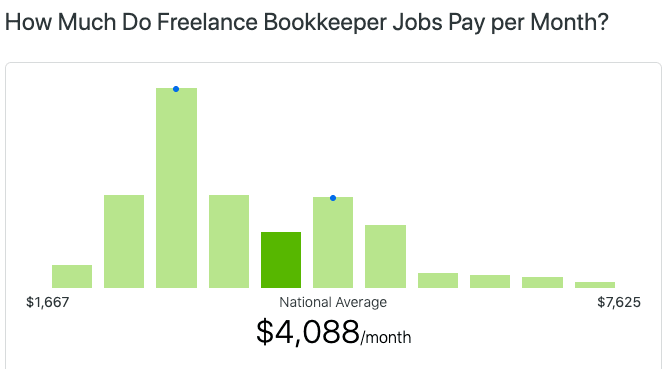

How Much Money Can Be Made with Bookkeeper Business Launch?

According to ZipRecruiter, as of May 25, 2019, the average annual pay for a Work From Home Bookkeeper in the United States is $58,745 a year.

So, thats the average.

The type of clients you work with along with your experience and education plays a vital role in determining the earning potential of your virtual bookkeeping business.

For example, if you work with specialised clients in the field of law or medicine, your income potential is higher.

While the course teaches you everything from bookkeeping to how to run and market a business profitably, a lot depends on you. For example, how much you charge and how you sell it to your clients.

As you can see by reading this section of this Bookkeeper Business Launch review, there is ample opportunity and money to be made here.

In fact, Ben Robinson is so sure of his course that he has a money back guarantee if you don’t earn $4000 in 90 days.

You should sign up for his free course to understand how to become a bookkeeper from home. It also answers all of your questions

Bookkeeper Business Launch Review: Is bookkeeper business launch worth it?

Is bookkeeper business launch worth it? Definitely!

We highly recommend Bookkeeper Business Launch if you are interested in bookkeeping.

If you are wondering about bookkeeper business launch complaint, we haven’t yet come across any and if we do, we plan to update this review

Not only is it the best course to help you become a proficient bookkeeper, it also helps you market your business and grow it faster than others without any training.

This concludes the first part of our Bookkeeper Business Launch review

Part II – Bookkeeper business launch review – Meet Kevin Schmidt

#1 Tell me something about yourself. What were you doing before you started bookkeeping?

Before I became a full-time stay/work from home dad, I was an administrator at a charter school.

I spent about 5 years in education, while running another side business I own with my wife, BeMyShopper.

I have always been in business/booking in one aspect or another, just never took it to the next level until I left my “career” job.

#2 Why and how did you decide to pursue this career? What was the driving factor?

I graduated college with a business degree and immediately began work in accounting for a defense contractor.

I have always enjoyed business and numbers so bookkeeping and accounting was always second nature to me.

When I left the accounting career and got into teaching, I picked up some side gigs, including some bookkeeping clients and running our first business, BeMyShopper.

I made the decision to pursue virtual bookkeeping as I saw the immediate need by so many small business owners out there and knew that I could reach so many of them and help them!

I figured with a couple of side gigs, I would be able to compensate for the loss in income when leaving my day job.

#3 What does bookkeeping involve?

I think the best way to describe bookkeeping on the entry level is to keep account of all the money going in and out of a businesses accounts, both bank and credit cards.

By doing that and properly allocating expenses correctly based on tax laws, the benefit can be exponentially helpful to a business owner.

When an owner can quickly see accurate financial statements on a routine basis, they are able to spend much more of their time focusing on strategies for their business.

#4 When did you take Bookkeeper Business Launch?

I started BBL back in the Summer of 2017.

It took me a few months to complete while working a full-time job.

You should sign up for his free course to understand how to become a bookkeeper from home. It also answers all of your questions

#5 Were you hesitant in the beginning?

Hesitant to join BBL?? NOT AT ALL!

I watched the free videos and took pages and pages of notes.

Ben kept me glued to the screen the entire time as he was presenting the information in such an easy to understand manner.

After I was done watching, I knew it was something that I HAD to do!

Relevant Reads on how to become a bookkeeper from home

- How to become a bookkeeper at home with no experience (+ free course)

- Bookkeeping jobs from home: 6+ companies that hire virtual bookkeepers!

#6 Why did you choose to go with Ben’s course? Did you any bookkeeper business launch review helped?

Like I mentioned before, Ben was teaching information, some that I already knew and other stuff that I didn’t, in such an easy to understand manner.

He made learning about bookkeeping and bookkeeping businesses sound fun and “easy” to do.

The details and road map that he was providing in JUST the intro videos had me hooked!

#7 How much bookkeeper business launch cost?

I do not recall the cost of it. As of today, it is $2499 for the entire program. You have instalment options

The price of Bookkeeper Launch has been recently updated to $2499-4999 depending on which course you buy.

#8 How long did you take to complete the bookkeeper business launch course?

It took me a few months to complete while working full-time.

#9 How is Ben as a mentor? [is he available to help you with your career]

Ben is an AMAZING mentor.

There are so many programs available besides BBL that Ben and his team has created.

He is very active in the social media groups that all members are part of. There are weekly meetings/webinars by him and his team.

So much good stuff! Once you join BBL, you join a family, and the support is amazing!

#10 Can the course be completed and actions can be taken while raising kids? How much time did you spend each day on building a bookkeeping business?

YES!

I completed the course while working a full-time job and raising 2 kids under 5 with my wife. It can definitely be done while raising kids.

I have been running my daily business while raising our newest/youngest daughter this past year.

#11 Does the course cover everything you need to know about bookkeeping?

Yes, the course covers pretty much everything you need to know.

And if the course does not, then there are so many tips/tools/resources available to fill in the gaps!

And then there are so many people both that work for BBL and that are just members of BBL that can help too!

#12 How long after completing the course did you land your first client?

I landed my first client about 6 weeks after completing the course. I was on the verge of leaving my full-time job so I was not putting much time into networking and trying to get new clients.

You should sign up for his free course to understand how to become a bookkeeper from home. It also answers all of your questions

#13 How long did you take to recover the cost you invested in the course?

I think recouped my cost the first month of my first client 🙂

#14 How much do you make a month doing this? Do you do this full time or part-time?

I am billing about $8,000 a month at this time.

My schedule Is flexible and I have the ability to work at different times during the day/night.

With three kids, sometimes I don’t have a full 8 hours a day to put in, but it’s great to have the flexibility.

#15 Please share any negatives and positive of the course (any drawback you would like to share)

I truly don’t think there is one negative thing about BBL.

I do not work for them and do not get paid to say this, but it is truly all positive.

BBL is constantly updating and finding things to do better. Once you join BBL, you are a member for LIFE and you get to enjoy all of the updates/resources the entire time.

#16 Do you think the course was necessary or you could have found the information for free on the internet?

Sure, I guess someone could do this without joining BBL, but the kickstart that you get with BBL is unmeasurable.

It’s so easy to say I’ll just read some books, google some things, and figure it out! The small investment that you make into BBL will pay back 10 times, quickly!

#17 How does it with clients (a little brief about where to get them, what kind of clients, how long are they signed up for etc)

I have received clients a few different ways. I have referral partners that I work with that send me bookkeeping clients.

In the beginning I also worked with some freelancing companies where they send clients. Then it has just been networking and word of mouth.

Clients that I have would then tell their friends about me or also bring their other businesses on board. All of my clients are month-to-month clients and can cancel with notice.

#18 How many hours do you work in a day?

I have a flexible schedule that allows me to enjoy time with my family and getting my work done for all of my clients.

My daily/weekly work is dependent upon time of month and certain projects/deadlines that come up.

#19 What according to you are the most important traits to be a successful bookkeeper?

I think staying knowledgable in the tax laws, current on technology out there for yourself and your clients, and being able to talk to people on a level that they understand is important.

Some of the best feedback I get from clients is that the actually understand what I am telling them and that I’m not talking way over their head with “accounting jargon” lol

#20 Do you think is a great job for a stay at home parent? Is it more suitable for parents of children who go to school or it is great for toddler parents as well.

YES, I 100% think it is a great job for stay at home parent.

It’s not the easiest with a toddler at home, but definitely doable as I have been doing it this year. You just find times during naps, lunch, etc…

#21 Do you have any advice for someone considering this career choice?

I think with any career choice, you hopefully are passionate about what you are doing and then you will find success.

Unlike just walking into a 9-5 job, this is YOUR career and YOUR business so it takes a little extra sweat and tears.

If you want to see great success then you have to put more time into it. If you are just wanting a little extra money on the side and are not looking to make it a full-time career, then that is possible too.

#22 How many kids do you have?

I have 3 kids. 7, 5, and 1

#23 How do you manage time and still raise a family?

Phew…this is definitely a tricky question!

I try to work as much as possible when the kids are not at home.

When I was first starting, I was doing a lot of night time hours but then that took time away from the wife. Because I have chosen to grow the business on a larger scale, we have started getting help with our youngest child just recently so that I can have more time during the day.

When the big kids get home, I try to be done.

Some days/weeks I have to keep going, but for the most part, I’m able to do school lunches/parties, take to karate/music lessons, etc.

Definitely WAY MORE flexibility then if I was at a 9-5 working for someone else!

#24 Is there anything else you want to share [Please tell us about anything you feel a beginner or someone interested in this WFH option should know]

I think the biggest advice would be to just take the leap and go for it!

It’s not a magic pill and things don’t just happen over night. If you are willing to learn some new knowledge, or if you already have the knowledge and just want to make some extra money, you can do it!

And BBL will definitely be jump-start for anyone, whether you have the experience or not!

Are you ready to join Ben Robinson Bookkeeping course?

Join Bookkeeper Business Launch Today

Part III – Quick FAQ’s about Bookkeeping from home

Do I need a college degree or experience to start bookkeeping from home?

It is completely ok.

If you read our Bookkeeper business launch review, you would have realized that it is self-paced program and teaches you everything from the scratch.

They teach you from knowing NOTHING about bookkeeping or running a business from home. According to Ben, 75% of his students had no prior knowledge or experience in bookkeeping

Why Bookkeeping is a great work from home option?

There are so many flexible options to work from home.

But, according to Entrepreneur Magazine, bookkeeping along with accounting is ranked as the #1 most profitable business on the planet.

The one and only reason I believe bookkeeping from home is a great stay at home job is because every business (small or large) needs to keep track of finances.

As a bookkeeper, your primary task is to keep track of finances which makes you a desirable professional.

Add in work from home and it the dream come true for stay at home moms and dad.

Isn’t it?

Watch this video to know th difference between accountant and bookkeeper

Is virtual bookkeeping legit?

Yes, virtual bookkeeping is legit option to make money from home.

We will talk about how to get started with online bookkeeping in just a bit.

How much do virtual bookkeepers from home earn?

According to Fit Small Business, you can expect to earn around $23 an hour as an entry-level bookkeeper BUT this is for bookkeepers that work in an organisation’s accounting department

If you are able to start your own online business and freelance independently, you can earn much more than just $18 an hour.

Considering you will work directly with multiple clients, the combined rate will be much more than $18 an hour.

You can start charging anywhere between $25-50 an hour depending on your existing skills, knowledge, and services offered.

Once you get experience in bookkeeping, you can easily charge $50-80+ an hour and up.

Note: You can also sign up for this free course to understand how to become a bookkeeper from home

What are your daily tasks as a bookkeeper from home?

People often confuse accountants and CPA for bookkeeping. They are different and the former needs a mandatory degree.

However, bookkeeping does not require you to have a college degree.

Let’s look at what a bookkeeper is required to do –

- Recording and receiving cash, checks etc

- Creating reports (including income statements and balance sheets)

- Using and keeping up with bookkeeping databases and software

- Entering financial transactions into bookkeeping softwares or spreadsheets (as required)

- Ensuring that client’s bills are paid on time

- Help them balance finances and maintain financial health etc

These are some of the most important tasks and as you can understand, no business can survive without these (especially without good financial health).

That also means that you have tonnes of opportunities for the right bookkeepers and that requires training.

Note: You can also sign up for this free course to gain skills and understand how to become a bookkeeper from home

Bookkeeper business launch can be the solution to this. It helps you learn the basics of bookkeeping and how to start a bookkeeping business from home

In short, not only does it teach you how to do it and market your business, but it also guides you step by step to reach your financial goals with bookkeeping career

Why not go a university or a community college to take bookkeeping classes or training?

You can, definitely.

But, you may end up spending a few years learning the essentials of a bookkeeping business.

While you may learn everything about bookkeeping, but you will also need classes on online business.

Bookkeeper business launch is a legitimate alternative to learn bookkeeping and how to run an online business from home.

It is one stop for your virtual bookkeeping business needs

Is online bookkeeping legit?

Yes, online bookkeeping is legit.

There are many businesses who need help with bookkeeping and they prefer to hire virtual bookkeepers to help them out with the work.

$2697 is an AWFUL lot of money to spend on a program. Is there a guarantee?

Bookkeeper Business Launch comes with one guarantee – In the first 60 days after you purchase, if you have any reason or think you are not 100% satisfied with Bookkeeper Business Launch, you can tell them

They will return all your money without asking you for a reason. Just send in a email and tell them to give back your money.

Join Bookkeeper Business Launch Today

/>

Carroll Bachtel

Tuesday 29th of October 2019

I really loved reading through this post. Occasionally I discover content that can make me want to begin bloggin myself. Many thanks!

Rebecca @ Boss Single Mama

Thursday 6th of June 2019

Another great post! I really appreciate how in-depth you go with your reviews. Bookkeeping is not something I've ever considered for myself as side hustle or online business. Too many numbers. :) But it sounds like there's some great earning potential for those who are interested in finance.